| | | |

Cyber Insurance Market Report 2021-2031

Forecasts by Type (Standalone Insurance, Packaged Insurance), by Cyber Event (Data-Malicious Breach, Unauthorised/Unintentional Disclosure, Physical Damage, Website Disruption, Phishing/Spoofing, Skimming/Tampering), by Coverage (Data Breach, Data Loss, Denial of Service/Down-time, Ransomware Attacks, Other Coverage), by Liability (Data Protection and Cyber Liability, Media Liability, Wrongful Data Collection, Infringement/Defamatory Content, Violation of Notification Obligations, Other Liability), by End-User (Financial Institutions, IT and ITES, Telecom Industry, Energy & Utilities, Media & Entertainment, Other) AND Regional and Leading National Market Analysis PLUS Analysis of Leading Cyber Insurance Companies AND COVID-19 Recovery Scenarios

| | | | |  |

The Cyber Insurance Market Report 2021-2031: This report will prove invaluable to leading firms striving for new revenue pockets if they wish to better understand the industry and its underlying dynamics. It will be useful for companies that would like to expand into different industries or to expand their existing operations in a new region.

Reinsurance plays a vital role in in enabling an insurance market to grow

Reinsurance plays a vital role in in enabling an insurance market to grow, particularly if insurers must cope with a new and unrecognized risk such as cyber risk. Global cyber reinsurance market is estimated to be worth $xxm. Most insurers (95%) buy proportional quota share reinsurance contracts, which is typical on immature markets, but due to intense competition non-proportional (Excess-of-Loss) structures are emerging. The portion of retained cyber risk in XL contracts varies across insurance companies

Cyber Insurance Sector Is Undergoing Several Waves of Development to Expand from Digital Assets to Encompass Physical Asset

Technology introduces a new set of hazards to both tangible and intangible assets, many of which are not covered by existing insurance policies, leaving businesses of all sizes vulnerable to cyber threats. Cyber insurance, as it has been described in the past, has primarily focused on digital assets such as customer data. Many traditional insurance lines, such as home, property, energy, and aviation, are migrating to cyber insurance by proxy as the magnitude, frequency, and effect of cyber catastrophes grows. interviews with industry experts back up this trend, predicting that the cyber insurance industry will extend from digital assets to include physical assets, as well as other asset classes including reputation, intellectual property, and business disruption, in numerous waves.

Key Questions Answered ?

• How is the cyber insurance market evolving?

• What is driving and restraining the cyber insurance market?

• How will each cyber insurance submarket segment grow over the forecast period and how much revenue will these submarkets account for in 2031?

• How will the market shares for each cyber insurance submarket develop from 2021 to 2031?

• What will be the main driver for the overall market from 2021 to 2031?

• Will leading cyber insurance markets broadly follow the macroeconomic dynamics, or will individual national markets outperform others?

• How will the market shares of the national markets change by 2031 and which geographical region will lead the market in 2031?

• Who are the leading players and what are their prospects over the forecast period?

• What are the cyber insurance projects for these leading companies?

• How will the industry evolve during the period between 2020 and 2031?

• What are the implication of cyber insurance projects taking place now and over the next 10 years?

• Is there a greater need for product commercialisation to further scale the cyber insurance market?

• Where is the cyber insurance market heading? And how can you ensure you are at the forefront of the market?

• What can be the best investment options for new product and service lines?

• What are the key prospects for moving companies into a new growth path? C-suite?

You need to discover how this will impact the cyber insurance market today, and over the next 10 years:

• Our 573-page report provides 381 tables and 356 charts/graphs exclusively to you.

• The report highlights key lucrative areas in the industry so you can target them – NOW.

• Contains in-depth analyse of global, regional and national sales and growth

• Highlights for you the key successful trends, changes and revenue projections made by your competitors

This report tells you TODAY how the cyber insurance market will develop in the next 10 years, and in-line with the variations in COVID-19 economic recession and bounce. This market is more critical now than at any point over the last 10 years.

Forecasts to 2031 and other analyses reveal the commercial prospects

• In addition to revenue forecasting to 2031, our new study provides you with recent results, growth rates, and market shares.

• You find original analyses, with business outlooks and developments.

• Discover qualitative analyses (including market dynamics, drivers, opportunities, restraints and challenges), cost structure, impact of rising cyber insurance prices and recent developments.

This report includes data analysis and invaluable insight into how COVID-19 will affect the industry and your company. Four COVID-19 recovery patterns and their impact, namely, V, L, W and U are discussed in this report.

Global Cyber Insurance Market (COVID Impact Analysis) by Type

• Standalone Insurance

• Packaged Insurance

Global Cyber Insurance Market (COVID Impact Analysis) by Cyber Event

• Data-Malicious Breach

• Unauthorized/Unintentional Disclosure

• Physical Damage

• Website Disruption

• Phishing/Spoofing

• Skimming/Tampering

Global Cyber Insurance Market (COVID Impact Analysis) by Coverage

• Data Breach

• Data Loss

• Denial of Service/Down-time

• Ransomware Attacks

• Other Coverage

Global Cyber Insurance Market (COVID Impact Analysis) by Liability

• Data Protection and Cyber Liability

• Media Liability

• Wrongful Data Collection

• Infringement/Defamatory Content

• Violation of Notification Obligations

• Other Liability

Global Cyber Insurance Market (COVID Impact Analysis) by End-User

• Financial Institutions

• IT and ITES

• Telecom Industry

• Energy & Utilities

• Media & Entertainment

• Other End-User

In addition to the revenue predictions for the overall world market and segments, you will also find revenue forecasts for 4 regional and 20 leading national markets:

• North America Cyber Insurance Market, 2021 to 2031 Market Outlook

• U.S. Cyber Insurance Market, 2021 to 2031 Market Forecast & COVID Impact Analysis

• Canada Cyber Insurance Market, 2021 to 2031 Market Forecast & COVID Impact Analysis

• Mexico Cyber Insurance Market, 2021 to 2031 Market Forecast & COVID Impact Analysis

• Europe Cyber Insurance Market, 2021 to 2031 Market Outlook

• Germany Cyber Insurance Market, 2021 to 2031 Market Forecast & COVID Impact Analysis

• Spain Cyber Insurance Market, 2021 to 2031 Market Forecast & COVID Impact Analysis

• United Kingdom Cyber Insurance Market, 2021 to 2031 Market Forecast & COVID Impact Analysis

• France Cyber Insurance Market, 2021 to 2031 Market Forecast & COVID Impact Analysis

• Italy Cyber Insurance Market, 2021 to 2031 Market Forecast & COVID Impact Analysis

• Rest of Europe Market Forecast & COVID Impact Analysis

• Asia Pacific Cyber Insurance Market, 2021 to 2031 Market Outlook

• China Cyber Insurance Market, 2021 to 2031 Market Forecast & COVID Impact Analysis

• Japan Cyber Insurance Market, 2021 to 2031 Market Forecast & COVID Impact Analysis

• India Cyber Insurance Market, 2021 to 2031 Market Forecast & COVID Impact Analysis

• Australia Cyber Insurance Market, 2021 to 2031 Market Forecast & COVID Impact Analysis

• South Korea Cyber Insurance Market, 2021 to 2031 Market Forecast & COVID Impact Analysis

• Rest of Asia Pacific Market Forecast & COVID Impact Analysis

• LAMEA Cyber Insurance Market, 2021 to 2031 Market Outlook

• Brazil Cyber Insurance Market, 2021 to 2031 Market Forecast & COVID Impact Analysis

• Turkey Cyber Insurance Market, 2021 to 2031 Market Forecast & COVID Impact Analysis

• Saudi Arabia Cyber Insurance Market, 2021 to 2031 Market Forecast & COVID Impact Analysis

• South Africa Cyber Insurance Market, 2021 to 2031 Market Forecast & COVID Impact Analysis

• UAE Cyber Insurance Market, 2021 to 2031 Market Forecast & COVID Impact Analysis

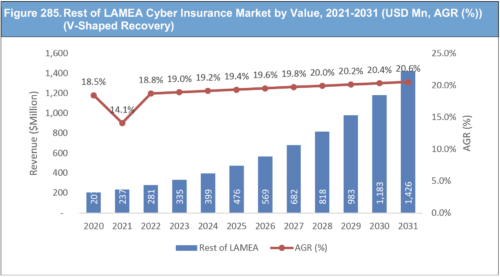

• Rest of Latin America, Middle East and Africa

The report also includes profiles and for some of the leading companies in the Cyber Insurance Market, 2021 to 2031, with a focus on this segment of these companies' operations.

Leading companies and the potential for market growth

• Allianz SE Financial Services Company

• American International Group, Inc

• Aon Insurance Company

• Aspen Insurance Holdings Limited

• AXA SA

• AXIS Capital Holding Limited Company

• Beazley PLC

• Berkshire Hathaway Inc

• Chubb Ltd

• CNA Financial Insurance Company

• Hartford Insurance Group

• Legal & General Financial services

• Lloyd's of London Insurance Company

• Lockton Companies

• Muenchener Rueckvrschrng Gslchft AG

• W. R. Berkley Insurance Group

• Zurich Insurance Group

• Markel Corporation

• Alleghany Corporation

• BCS Financial Corporation

How the Cyber Insurance Market, 2021 to 2031 Market report helps you?

In summary, our 570+ page report provides you with the following knowledge:

• Revenue forecasts to 2031 for Cyber Insurance Market, 2021 to 2031 Market, with forecasts for type, cyber event, coverage, liability, end-user each forecasted at a global and regional level– discover the industry's prospects, finding the most lucrative places for investments and revenues

• Revenue forecasts to 2031 for 4 regional and 20 key national markets – See forecasts for the Cyber Insurance Market, 2021 to 2031 market in North America, Europe, Asia-Pacific and LAMEA. Also forecasted is the market in the US, Canada, Mexico, Brazil, Germany, France, UK, Italy, China, India, Japan, and Australia among other prominent economies.

• Prospects for established firms and those seeking to enter the market– including company profiles for 20 of the major companies involved in the Cyber Insurance Market, 2021 to 2031 Market. | | | | |  |  |  | | Contact permission

We are sending you this email communication as we believe that your business may benefit from our services and offers. We process your data and promote to you on the basis of this legitimate interest in line with the GDPR guidance of the ICO and the DMA. The only information that we hold that is personal to you is your name, business affiliation, contact details (that may include email). It has been collected because you are engaged with a business or organisation that buys or uses business information. The data will be kept secure and accurate and is not shared with anyone. The information is held under the Legitimate Interest clause in the General Data Protection Regulation. We abide by all communication laws pertinent to your country. Our full privacy policy can be reviewed on our website.If you no longer wish to receive marketing communication from us, please unsubscribe here.

Terms and Conditions

By replying to this email submitting your order for this product you have agreed without limitation or qualification to be bound by and to comply with these Terms and Conditions. You agree that you will not fail to complete any transaction after submitting an order to purchase a product or submit any order to purchase a product where you do not intend to complete the transaction. Management Reports will only be sent on receipt of payment.

Our mailing address is: Visiongain Ltd., Airport House, Purley Way, London, UK. CR0 0XZ | | | | | | | | |

Комментариев нет:

Отправить комментарий